The placed in service date for your property is the date the property is ready and available for a specific use. If you converted property held for personal use to use in a trade or business or for the production of income, treat the property as being placed in service on the conversion date. See Placed in Service under When Does Depreciation Begin and End? In chapter 1 for examples illustrating when property is placed in service. Although your property may qualify for GDS, you can elect to depreciable assets use ADS.

What Is the Basis for Depreciation?

Generally, for the section 179 deduction, a taxpayer is considered to conduct a trade or business actively if they meaningfully participate in the management or operations of the trade or business. A mere passive investor in a trade or business does not actively conduct the trade or business. The recovery period for ADS cannot be less than 125% of the lease term for any property leased under a leasing arrangement to a tax-exempt organization, governmental unit, or foreign person or entity (other than a partnership).

Modified Accelerated Cost Recovery System (MACRS)

The cost of land generally includes the cost of clearing, grading, planting, and landscaping. If Maple buys cars at wholesale prices, leases them for a short time, and then sells them at retail prices or in sales in which a dealer’s profit is intended, the cars are treated as inventory and are not depreciable property. In this situation, the cars are held primarily for sale to customers in the ordinary course of business.

- If at least 25% of the total use of any aircraft during the tax year is for a qualified business use, the leasing or compensatory use of the aircraft by a 5% owner or related person is treated as a qualified business use.

- You must generally file Form 3115, Application for Change in Accounting Method, to request a change in your method of accounting for depreciation.

- Writing off only a portion of the cost each year, rather than all at once, also allows businesses to report higher net income in the year of purchase than they would otherwise.

- For information on ACRS elections, see Revocation of election in chapter 1 under Alternate ACRS Method .

- If you claim a deduction for any vehicle, you must answer certain questions on page 2 of Form 4562 to provide information about the vehicle use.

- Businesses may decide to dispose of an asset if they sell it, in case of theft, or if the asset depreciates fully.

How Else Does TAS Help Taxpayers?

Thus, the yearly depreciation expense will decrease over time. From an accounting perspective, depreciation is the process of converting fixed assets into expenses. Also, depreciation is the systematic allocation of the cost of noncurrent, nonmonetary, tangible assets (except for land) over their estimated useful life. For certain qualified property acquired after September 27, 2017, and placed in service after December 31, 2022, and before January 1, 2024, you can elect to take a special depreciation allowance of 80%. This allowance is taken after any allowable Section 179 deduction and before any other depreciation is allowed. A way to figure depreciation for property that ratably deducts the same amount for each year in the recovery period.

Example of Double-Declining-Balance Depreciation

I made the following infographic to give you law firm chart of accounts some examples of depreciable assets in a small business. The most common reason for an asset to not qualify for depreciation is that the asset doesn’t truly depreciate. The land is not a depreciable business asset because its useful life is infinite. Disposal of an asset eliminating an asset from an organization’s accounting records. Businesses may decide to dispose of an asset if they sell it, in case of theft, or if the asset depreciates fully. As noted above, companies must begin depreciating assets once they place them into service.

At the end of 2022 you had an unrecovered basis of $14,565 ($31,500 − $16,935). If in 2023 and later years you continue to use the car 100% for business, you can deduct each year the lesser of $1,875 or your remaining unrecovered basis. The numerator of the fraction is the number of months and partial months in the short tax year, and the denominator is 12.. The following worksheet is provided to help you figure the inclusion amount for leased listed property. Other property used for transportation does not include the following qualified nonpersonal use vehicles (defined earlier under Passenger Automobiles).

Classes of Recovery Property

It also explains how you can elect to take a section 179 deduction, instead of depreciation deductions, for certain property and the additional rules for listed property. Do not subtract salvage value when you figure your yearly depreciation deductions under the declining balance method. However, you cannot depreciate the property below its reasonable salvage value. Determine salvage value using the rules discussed earlier, including the special 10% rule.

- For passenger automobiles and other means of transportation, allocate the property’s use on the basis of mileage.

- Usually, a percentage showing how much an item of property, such as an automobile, is used for business and investment purposes.

- For this purpose, however, treat as related persons only the relationships listed in items (1) through (10) of that discussion and substitute “50%” for “10%” each place it appears.

- Payments of U.S. tax must be remitted to the IRS in U.S. dollars.

- In May 2023, Sankofa sells its entire manufacturing plant in New Jersey to an unrelated person.

- For 1985 through 1988, you figured your ACRS deductions using 11%, 9%, 8%, and 7% × $98,000.

- Duforcelf, a calendar year corporation, maintains a GAA for 1,000 calculators that cost a total of $60,000 and were placed in service in 2020.

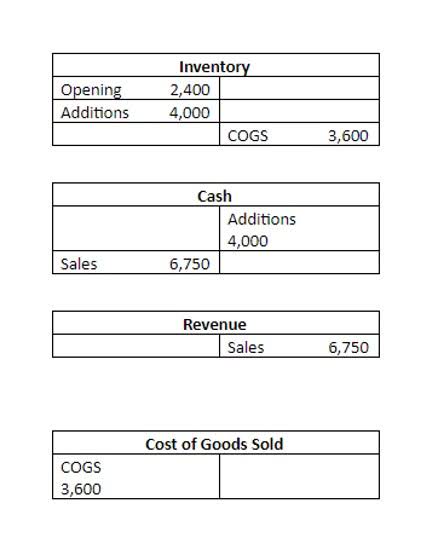

Cost is defined as all costs that were necessary to get the asset in place and ready for use. Depreciation is necessary for measuring a company’s net income in each accounting period. To demonstrate this, let’s assume that a retailer purchases a $70,000 truck on the first day of the current year, but the truck is expected to be used for seven years.

If you have a short tax year after the tax year in which you began depreciating property, you must change the way you figure depreciation for that property. If you were using the percentage tables, you can no longer use them. You must figure depreciation for the short contribution margin tax year and each later tax year as explained next. For a short tax year of 4 or 8 full calendar months, determine quarters on the basis of whole months. The midpoint of each quarter is either the first day or the midpoint of a month. Treat property as placed in service or disposed of on this midpoint.